Latest Version

7.21.1

February 08, 2025

Current

Finance

Android

1

Free

com.current.app

Report a Problem

More About Current: The Future of Banking

Current is a financial technology company that provides various banking services but is not an FDIC-insured bank. This means that while it does offer some protections for customers' funds through pass-through insurance with partner banks like Choice Financial Group and Cross River Bank, this insurance is contingent on certain conditions being fulfilled. Notably, traditional FDIC insurance covers only the failure of banks that are FDIC-insured, which is important for users to understand when they deposit their funds.

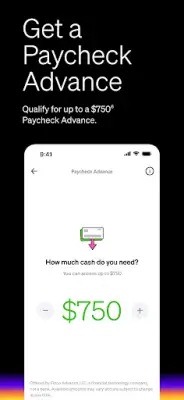

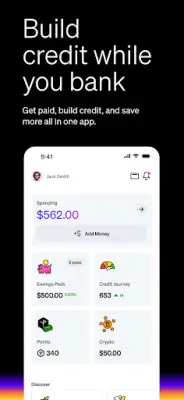

One of the standout features of Current is its ability to help users build credit without requiring credit checks. Customers can utilize the Build Card to enhance their credit score while managing their banking activities. Additionally, Current offers a Paycheck Advance up to $500 without mandatory fees, making it easier for users to access funds when needed. Alongside these features, customers benefit from fee-free cash withdrawals at over 40,000 Allpoint ATMs across the U.S., which helps in reducing the costs generally associated with ATM usage.

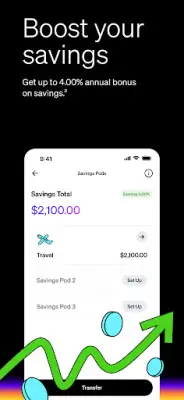

Current also ensures that users receive their funds faster through direct deposits, potentially arriving up to two days earlier than with traditional banks. This promptness is beneficial for individuals who rely on quick access to their funds. Additionally, the platform offers a fee-free overdraft of up to $200 for eligible customers, providing a safety net for those who may occasionally overspend. For savers, Current promises rewards such as earning up to 4.00% annual bonus on savings, which is a competitive rate compared to standard offerings in the industry.

Moreover, Current enriches the user experience by offering rewards in the form of points on purchases at grocery stores and restaurants, engaging users in everyday spending. The app supports users with 24/7 customer service, ensuring assistance is available at all times. For more details on the terms and conditions of these services, users are encouraged to visit Current's official website. In sum, Current combines modern banking features with innovative financial tools, appealing to a diverse customer base looking for alternatives to conventional banking.

Rate the App

User Reviews

Popular Apps